Saks C.E.O. Steps Down Amid Debt Crisis

Saks Global’s CEO Marc Metrick has resigned as the luxury retailer grapples with mounting debt and a missed interest payment, raising bankruptcy fears.

Leadership Transition

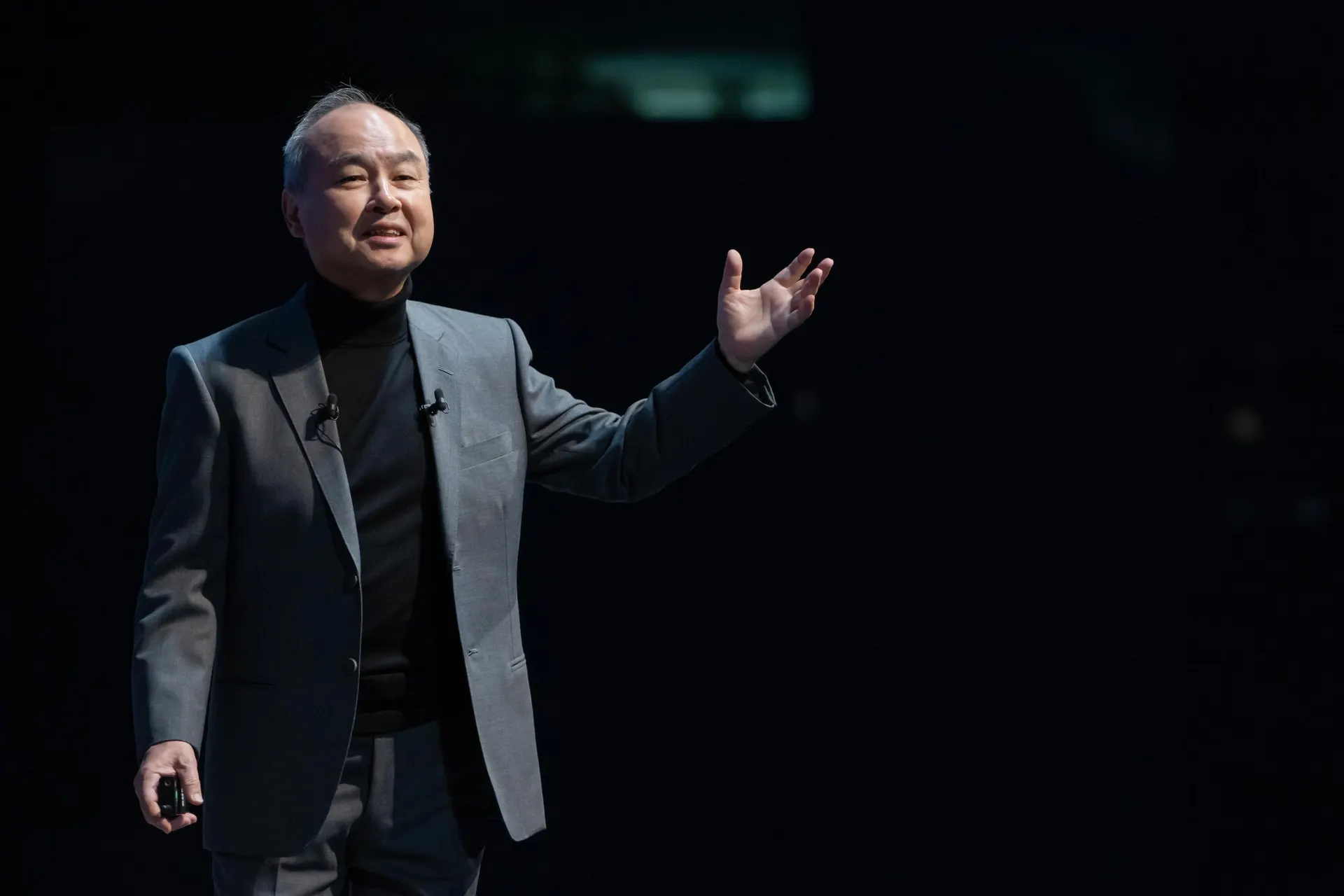

Marc Metrick, who led Saks Fifth Avenue since 2015 and Saks Global post-2024 Neiman Marcus merger, stepped down immediately to pursue new opportunities. Executive Chairman Richard Baker, a real estate veteran behind the Saks-Neiman union, assumes the CEO role while retaining his chairman position. Baker aims to drive transformation amid financial strain, emphasizing store appeal and service continuity.

Debt and Sales Woes

Saks missed a major interest payment on $2.2 billion debt from the Neiman acquisition, prompting creditor talks and potential Chapter 11 filing. Q3 revenue plunged 13% to $1.6 billion through August, with S&P deeming its capital structure unsustainable due to rising $400 million annual interest. Vendor payment delays and luxury spending slowdowns from inflation exacerbated liquidity issues despite asset sales like Beverly Hills Neiman property.

Strategic Challenges

Post-merger, Saks sought synergies with Saks Fifth Avenue, Neiman Marcus, and Bergdorf Goodman to rival Nordstrom and Macy’s, but sales faltered. Efforts included digital upgrades and debt restructuring, yet luxury market headwinds—warned by Bain as the worst in 15 years—hit hard. Metrick’s tenure focused on brand distinction and customer experience, but debt burden overshadowed gains.