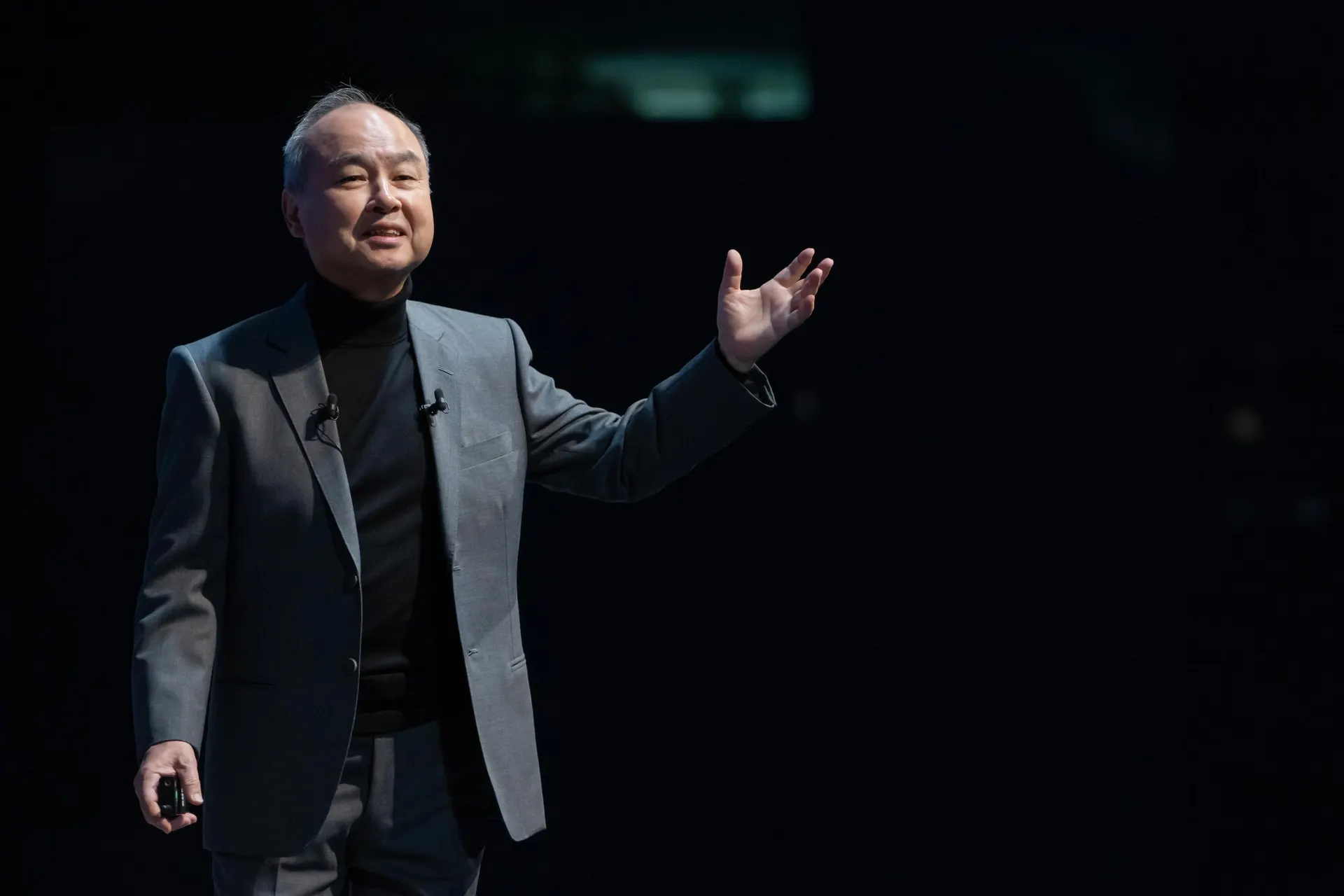

SoftBank Doubles AI Bets With $4 Billion DigitalBridge Deal

Billionaire Masayoshi Son’s SoftBank Group agreed to acquire DigitalBridge Group for $4 billion, bolstering its AI infrastructure amid surging demand for data centers and connectivity.

Deal Highlights

SoftBank will buy all DigitalBridge shares at $16 each in cash, a 15% premium to the December 26, 2025 closing price and 50% above its 52-week average. The transaction, unanimously approved by DigitalBridge’s board, expects closure in the second half of 2026 pending regulatory nods, with DigitalBridge operating independently under CEO Marc Ganzi.

Strategic AI Push

Son emphasized the need for more compute power, connectivity, and scalable infrastructure as AI reshapes industries globally. DigitalBridge’s expertise in data centers, cell towers, fiber networks, and edge assets complements SoftBank’s Vision Fund bets, including OpenAI and a $500 billion Stargate project.

Infrastructure Race

The deal positions SoftBank to finance and scale next-gen AI facilities, addressing bottlenecks in training massive models. Ganzi hailed it as a generational opportunity in AI infrastructure, leveraging SoftBank’s global reach and capital. This move signals a pivot from pure software plays to owning the physical “picks and shovels” of the AI economy.